One of the most important things we do at Credit Repair Plus is educate our clients about the various aspects of credit and credit repair and restoration. Here, you’ll find a wealth of information that will not only give you a better understanding of how credit works, but provide you with the valuable information you need to make the best possible choices when securing a loan.

This section is divided up into 8 main topics:

The Laws Governing the Use of Credit.

The Fair Credit Reporting Act gives you the right to review and correct your credit reports. It also controls the proper use of credit reports (determines for what purpose they can be used) and requires reporting agencies to maintain complete and accurate information (this does not mean they always do so).

Credit Report Errors – The bureau in question is responsible for changing or removing any incorrect data or erroneous information.

Denied Credit – If you’ve been denied credit, the lender must give you the name and address of the creditor that issued the denial report. You can request a free copy of this report for up to 30 days.

Disclosure – Reporting agencies must provide the identity of all those requesting your credit information and allow you to have complete access to the information contained in your credit report.

Issuing Credit Reports – The FCRA protects you by saying that only those who have a legitimate reason (loan, mortgage, lease, retail credit) can request your credit information. Also, it dictates that credit bureaus are required to assist you with understanding your credit reports.

Limiting Access – Many creditors make unsolicited offers of credit. You have the right to limit the inclusion of your name on these lists.

Equal Credit Opportunity Act (ECOA)

Regardless of race, age, religion, gender or marital status, the Equal Credit Opportunity Act states that all consumers are given an equal chance to obtain credit and you cannot be denied credit based on the attributes above.

Prohibited Information – Credit applications and lenders (verbally) are not allowed to ask you about your race, color, religious affiliation, sex, marital status or whether or not you have children or plan to have children as a qualifier for credit.

Credit for Couples – Married couples have the right to request separate credit reports and histories, even for joint accounts. If an account is listed under only one spouse’s name, the other spouse has the right to rely on that credit history as well. Married women are allowed to use either their birth or married name.

Divorced Individuals – This part of the ECOA states that you can be asked about child support, alimony or maintenance and how it affects your income. However, if you don’t plan on using these funds to pay off your loan, you don’t have to list them on your application.

Age – Only those of legal age are eligible for loans and credit. For that reason, creditors are allowed to ask your age.

Changed Circumstances – The details and terms of your credit cannot be changed due to a change in status, such as marriage or retirement. Also, once a loan is terminated, you cannot be forced to reapply for that loan.

Applicant Notification – Any time you apply for a loan, you must be notified of the decision within 30 days. If the loan is denied, the lender or creditor must provide a written statement as to why the loan was not granted.

Fair Credit Billing Act (FCBA)

During the time a credit report in is dispute, creditors cannot report an associated account as delinquent. This act also requires the prompt correction of any errors on open-ended accounts.

Fair Debt Collection Practices Act (FDCPA)

This act states that the collectors of loans can not employ unfair, deceptive or abusive practices including anonymous phone calls, making threats, using obscene language, making a debt public, or carrying out any kind of harassing behavior.

Credit Myths and Misconceptions.

Here are some common myths and misconceptions:

- Paying cash for everything will help your credit rating.

Using cash for all your transactions does not have an effect on your credit (other than you are not using loans, lines of credit or credit cards). - Paying off collections, tax liens and late payments will remove them from your credit report.

Resolving the balance on these items is no guarantee they will be removed from your report. On the contrary what usually happens is the negative in question will have the clock reset for how long it should remain on your report and will continue affecting your credit score for years to come. You must continue to monitor the situation until the items are truly removed. - All of your credit reports and credit scores will be the same.

It’s not unusual for reports to differ from credit bureau to bureau. Plus, major banks and creditors often have their own method of determining your credit score. - If you have poor credit, your credit scores will suffer for seven years.

The seven year “rule” pertains to a certain type of bankruptcy, not credit issues. Credit issues can be resolved quickly, sometimes in a matter of days or weeks. - Making a lot of money will improve your credit report and scores.

Income is not a big factor in your credit rating. More important is how you spend your money in terms of using credit to do so. - Divorce will absolve you of your credit responsibilities.

The effect on your credit depends on your divorce decree, settlement and your history of sharing credit accounts with your spouse. The Equal Credit Opportunity Act states that married couples have the right to request separate credit reports and histories, even for joint accounts. If an account is listed under only one spouse’s name, the other spouse has the right to rely on that credit history. - Closing credit card accounts will improve your credit scores.

A closed credit card account is considered “static” information (not being used) and has little effect on your credit. On the contrary, closing credit card accounts in good standing will generally cause your credit score to decline. - The proper and responsible use of debit cards can help your credit reports and scores.

Debit cards do not have an impact on your credit status.

Experian, Equifax and TransUnion.

The big three: Experian, Equifax and TransUnion are in the business of buying and selling credit information and they play no part in the credit repair or restoration process unless they are requested to do so. They are not a government agency, a public service nor do they act as a watchdog and contact you about possible problems with your credit. It’s also very important to know that they are responsive not proactive companies. In other words, you have to go to them to repair any false charges or erroneous information. Until you do, they assume all is well with your credit report(s).

Every time you ask Experian, Equifax and TransUnion to look into problems with your credit report (including disputing information or asking that an item be removed), it costs them money. It only follows that they will sometimes take measures to avoid acting on your behalf.

But with Credit Repair Plus in your corner, you’ll be able to deal with the “big three” in the most efficient and effective way possible. We have years of experience with these credit bureaus and know exactly how to deal with them to get real results in the shortest amount of time possible.

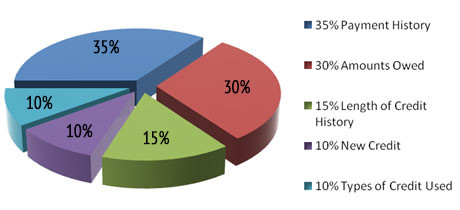

How Your Credit Score is Determined.

Below is a breakdown of the main factors used to determine your credit score. These are approximations. For example, major banks and other lenders may use their own systems to generate your credit score.

Payment History (35%)

- Payments due and past due, including how long they are past due

- Your payment history for specific accounts such as installment loans, mortgages, credit cards, and

purchases or services - The number of past due items on file (whether the information is accurate or not)

- Adverse public proceedings such as suits, liens, bankruptcy, wage garnishments, judgments, and

accounts turned over to collection - The time that has passed since any public proceedings

- The number of accounts paid per each agreement with dates and amounts paid

Amounts Owed (30%)

- Proportions and percentages of credit lines used

- How many accounts you have with current balances

- Amounts owing on such accounts

- Installments and the balance (proportion) compared to the original loan

- Amount owed on various and specific types of accounts

Credit History (15%)

- Time since accounts were applied for and opened

- Time since the last activity (payment or purchase) for each account

New Credit (10%)

- Accounts recently opened and the proportion of various types of accounts

- Number of recently opened accounts

- Recent credit inquiries from lenders including retail and credit agencies

- Time since your last credit inquiry

- Restoration and repair of positive credit

Types of Credit Used (10%)

- Types of credit: mortgages, installment loans, credit cards, retail accounts (stores) and consumer finance accounts and the prevalence (percentage) of the different types of credit used

Naturally, we are fully aware how credit scores are calculated and attend to each and every detail when restoring your credit. We use this information to make sure we have attended to absolutely every aspect of your accounts. Credit Repair Plus will help you achieve the highest credit rating possible.

Who Has Access to Your Credit Information.

When you take out an insurance policy, apply for a loan, make a purchase on credit or even fill out an application to rent a home or apartment, the creditor (or landlord or insurance agent) involved has the right, under most circumstances, to look at your credit report. This includes auto dealerships and mortgage companies. Potential employers may request your credit information as part of their hiring process, but in most cases, they cannot do so without your permission. If you apply for a job where you will be dealing with large amounts of money or are solely responsible for a large budget, the employer may insist that you agree to allow them access to your credit information.

Unfortunately, your permission is not required when inquiries are made as part of a pre-approved credit offer.

The Costs of Having Poor Credit.

The most unfortunate aspect of having poor credit is you may have difficulty securing a loan and you’ll pay higher interest rates if you get that loan. Over the course of a home mortgage for example, higher interest rates brought on by poor credit and a low credit score means higher monthly payments and the fact that you may end up paying as much as an additional $150,000 for your home over the course of the mortgage. That’s why we will help you restore your credit and put you in a position to secure the best possible rates when purchasing large ticket items such as a home or vehicle.

In addition, you may have to pay higher interest rates for credit cards and auto loans and perhaps have to place a cash deposit to secure that credit card and come up with a larger down payment for that auto loan. Even utilities such as power, water, cable and telephone service may require a larger security deposit. Credit Repair Plus will help you avoid these additional expenses.

Poor credit can also cost you in the sense that it is much more stressful to deal with all the issues surrounding your personal finances when you have credit problems

Here are some of the challenges you’ll face if you have poor credit:

Obtaining an auto loan

Getting a mortgage

Renting an apartment, house, condo or office

Securing a credit card or line of credit

Taking out a life or auto insurance policy

Paying bills online

Utilities (security deposits)

Renting a car

Employment history and securing work

The Dispute Process.

Credit Repair Plus has successfully carried out the dispute process for hundreds of clients and we have years of experience getting real results as quickly and efficiently as possible.

Preventive Measures.

Here are some statistics:

- 70% of credit reports contain errors that might cause consumers to be denied credit cards, car loans or mortgages.

- Over 50% of credit reports contain personal information that is misspelled, outdated, or belongs to someone else.

- Over 20% of reports list the same mortgage or loan twice.

- 30% of credit reports contain credit accounts that had been closed but remained listed as open.

- 8% of credit reports were missing the kind of positive credit information that contributes to a high credit score.

That’s why you need Credit Repair Plus to keep a close eye on your credit report and credit standing.

You can reduce the risk of serious problems with your credit by taking preventative measures such as:

- Requesting copies of your credit report(s) on a regular basis.

- Confirming that payments have been posted.

- If you’re having trouble meeting the minimum payment on a credit card or loan, contact your utility companies (water, power, cable, phone, etc.) and explain the situation. They are more willing to postpone a payment or set up a payment plan and doing so won’t hurt your credit.

- Don’t over extend your credit or use it unwisely and unnecessarily.

The best protection

The world of credit is more complex and challenging than ever before. Even small changes in the economy can cause major changes in the way credit is extended and secured. The best protection is to have Credit Repair Plus monitor your credit and deal with any issues that arise. The small fee for this service pales in comparison to what an error in your credit report can cost you in terms of time and money.

You need someone to protect your credit and maximize your score. You need Credit Repair Plus.